Iran Steel Market Review

What happened during last Iranian Year, what is expected in the New Year

During last Iranian year ( March 2011- March 2012) , steel market was faced with special events, which will be reminded of as an influential and historical year in economic term. It was the first year which effects of subsidy reforming plan became apparent.

These events were:

1- Harsh volatilities of exchange rate in the last month of first quarter (May/June), which put 1USD at a record of Rials 14,000. The fluctuation led to depression of markets for a quarter. Second volatility in exchange market which appeared in last quarter, made investments get out of steel market to gold and exchange or other liquid markets with lower price risks, especially small apartments

2- Subsidies reforming plan, usually comes with high inflation, but in Iran steel market it showed itself in December 2011- January 2012, as government tried to control prices in Iran Mercantile Exchange (IME). Prices started increasing by end of December as government had been freezing price at IME for previous 9 months. Steel market was faced with low supply level but of course not just due to fixed prices at IME, but other factors were involved too.

3- LC opening problems especially in second half of last Iranian year (late September onward) put many importers in trouble. Any country when omitting subsidies needs a powerful foreign trade, but unfortunately sanctions against Iran and banking troubles for importers made the situation for steel trade a little harder.

During first 11 months of a year before (Mar 2010-Feb 2011) Iran had imported 4.774 million tones of billet, but during same period of last year it became 2.373 m tons , which shows 50% drop. HRC import level for same period of last year was 1.920m tones compared with 1.646 m tones of this year. These 2 products which are very important for steel market as raw materials for other steel products, faced with harsh drops. It would be noted that during previous Iranian year( Mar 2010-2011) about 7.893 m tones of steel products were transacted at IME, which decreased to 7.300 m tones for last year.

4- Last year, governmental project for affordable houses (maskan mehr) was near to its last phase, so its steel demand declined. Beside lower steel demand for infrastructure projects, banks hard conditions for lending, caused steel market depressed harshly and directed investments to other sections especially real estate which has enough capacity to substitute steel capitals, but return of capitals from this sector is not easy and fast, so huge amount of money is blocked for at least a year. This situation will make steel market transactions be done in cash payment which would be helpful and avoid late payment or bankruptcies, but market volume trend will collapse heavily which effect on production level.

Average steel price in Iran market increased by 39.2% at the end of this year compared with beginning of the year (March 2011), main part of price rise experienced during last quarter of the year which was faced with many influencing factors including higher ex-rate, limited raw material supply, lower import level, shortage of bank facilities and many other factors mentioned above.

Now let's see what are the effects of last year trend on New Iranian Year ( 20 March 2012 onward). There are 2 main views regarding this, as hereunder;

First view believes in upward trend in steel products prices, due to following reasons:

1- Supply production Subsidies will be omitted for steel mills, which will increase cost prices up to 30%.

2- Next year we will have multi-exchange rate system, steel import are base on official ex-rate, while volume actually will be limit

3- There are rumors in the market about higher official ex-rate in the New Year. May be Rials14, 000/USD instead of today's Rials12,260/USD

4- problems for opening LCs may continue and get worse.

It should be noted that steel products are mostly being imported from CIS countries but through third party . Currently situation for opening LC in Ruble has been comforted, but yet there are problems such as:

1-CIS is not a flexible and comfortable partner for any trade.

2- it has Higher costs for exporters as they have to bear ex-rate risk and need more cash to pay the mills.

2- A few suppliers will accept and have possibilities to do business in Ruble, so competition area will be much limited, and Iranian importers will have short allowcation of steel import.

3- Possibility of serious sanctions by July 2012 will decrease raw materials supply level to Iran steel market.

4- During last year Iran Steel export market improved, so it is expected to continue and will help prices rise.

Second view believes that Iran steel market will be silent at least for first quarter of the New Year (Mar-Jun 2012) as:

1- Opened LCs during last 2 months of the current year, at exchange rate of 1USD/12,260 Rials, will reach domestic market in Q1. For instance,cost price of billet which was bought at USD670/mt, would be Rials 9,200/kg. Korean debar bought by LC in Korean Won at USD780/mt, will be Rials11, 000/Kg cfr Imam Khomeini port after custom duty and 5% VAT. These import quantities won't let domestic prices change significantly during Q1.

2-New year government budget has not been announced at parliament yet, so government won't have any budget for housing or infrastructure projects during next 2 months, as a result steel demand will stay at its lowest level.

3-This view believes that it's not the first time which Iran market is facing with troubles for opening LC. The country with history of thousands of years in trade activities with smart traders will have solutions, but of course there would be up and downs.

4-Government will continue it's control on steel price in IME

5- As the main part of steel consumption in Iran is being produced by domestic mills, volatilities in prices would be limited.

Finally, it won't be denied that New Year can be full of unexpected movements in steel market. From one side implementing subsidy reforming plan continues, by other side sanctions against Iran should be worth of concerns. In one side a sluggish market is expected, at the other side inflation.

But apart from that, Iran is a country with enough resources for steel production such as raw materials, workforce and enough sources of energy. They just need correct planning and management to make this year a reminding one for Iran Steel industry. Last year many new steel mills started production, especially billet, which may lead to more steel products export in coming year.

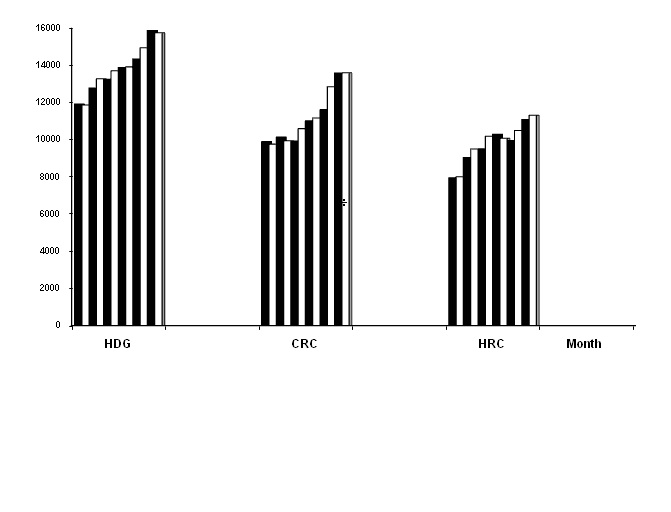

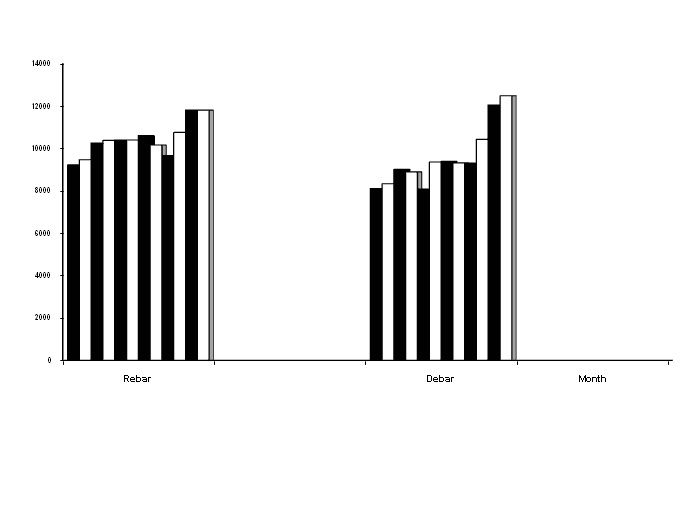

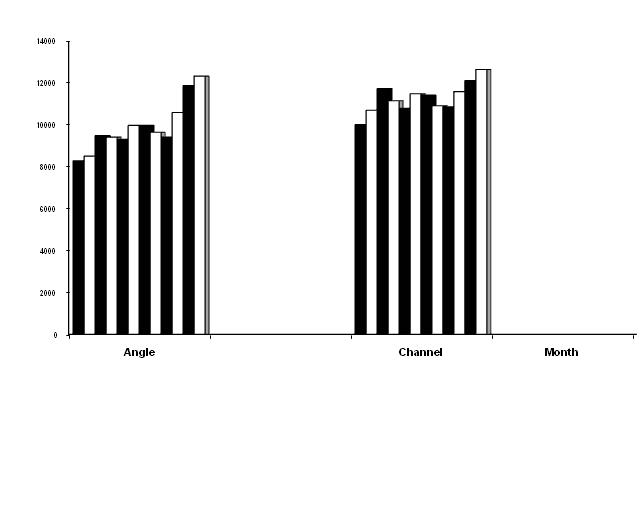

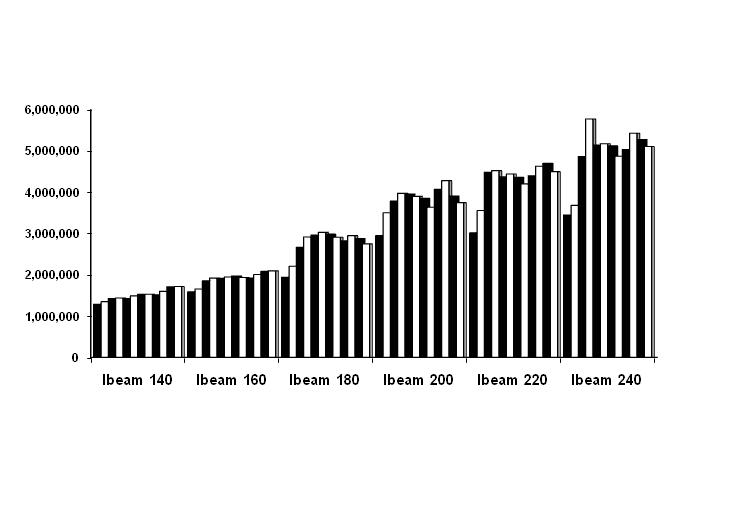

Steel products price changes in domestic market

(March 2011- March2012)

Change % | March 2012 Rials/Kg | March 2011 Rials/Kg | Product |

+32 | 15,763 | 11,933 | HDG |

+37 | 13,613 | 9,902 | CRC |

+42 | 11,321 | 7,950 | HRC |

+28 | 11,805 | 9,222 | Rebar |

+54 | 12,481 | 8,100 | Debar |

+48 | 12,346 | 8,303 | Angle |

+26 | 12,665 | 10,036 | Channel |

+33 | 1,714,667 | 1,285,667 | Ibeam-140 |

+32 | 2,092,667 | 1,583,333 | Ibeam-160 |

+41 | 2,748,333 | 1,937,333 | Ibeam-180 |

+27 | 3,746,667 | 2,948,000 | Ibeam-200 |

+49 | 4,498,667 | 3,016,667 | Ibeam-220 |

+48 | 5,105,333 | 3,443,333 | Ibeam-240 |

+53 | 5,984,667 | 3,891,333 | Ibeam-270 |

+39.2 | Average | | |

*Ex-rate: Official; Rials 12,260/USD

Market; Rials 18,800/USD

*I-beam price is per PC

Steel price fluctuations in domestic market

(March 2011- March2012)

M. Chitsaz

Iran Steel Service Center